Beginning Inventory: Definition, Importance & 4 Methods to Calculate Opening Inventory in 2023

The beginning of a new accounting period, like the latest financial year, brings along new levels of supply chain inventory. Inventory is an important aspect of every eCommerce business and the amount of opening inventory available at the start of an accounting period can provide insights into a company’s performance in the previous cycle. In this article, we will take a look at what beginning inventory is, the methods to calculate it and its importance. Keep reading.

What is Beginning Inventory?

Opening inventory is the book value of inventory that is available at the beginning of an accounting period. It also includes the stock value carried forward from the previous period. It is counted as a current asset in the financial books. Furthermore, it helps calculate the average inventory value during a specified time period and helps to determine the cost of goods sold. It is also called the beginning inventory value of a company. Its calculation depends on several factors.

4 Methods to Calculate Opening Inventory

Find the Cost of Goods Sold for the Previous Accounting Period

The cost of goods sold (COGS) is the expense that you incur for manufacturing products and preparing them for sale. It is the sum of the beginning inventory and inventory bought during the last accounting period, excluding the ending stock in the same period. It is also the total per-unit cost to a company for each sale. The lower the COGS and higher the product cost price, means higher revenue margins for the company. All gross profits and expenses on product sales qualify as inventory metrics. The formula is listed below:

Opening Inventory = (Beginning Inventory + Inventory Purchased During the Last Accounting Period) – Ending Inventory of the Same Period

Find Your Ending Inventory Balance

This figure depends on the opening inventory, net purchases for the last accounting period and the cost of goods sold. Here’s the formula:

Ending Inventory = (Beginning Inventory of the Last Accounting Period + Net Inventory Purchase in the Same Period) – COGS

Determine the Cost of Purchases Made

It is the money spent on buying additional inventory. This number helps decide your working capital requirements. It depends on the value of your opening inventory and ending stock in the previous accounting period and adds the cost of goods sold. It is calculated as follows:

Cost of Purchases = (Ending Inventory – Beginning Inventory in the Last Accounting Period) + COGS

This formula doesn’t work well for labour-intensive sectors, like manufacturing, where the cost of goods sold depends on factors other than the inventory. Such elements make the calculation of actual goods sold trickier.

Use the Opening Inventory Formula

There are a couple of opening inventory formulas to calculate opening stock:

- For manufacturing enterprises:

Opening Inventory = Cost of Raw Materials + Value of WIP Goods + Cost of Finished Goods

- When we know the cost of goods sold, closing inventory and sales data:

Opening Inventory = (COGS + Ending Inventory in the Last Accounting Period) – Inventory Purchased in the Same Accounting Period

Or

Opening Inventory = Sales – Gross Profit – (COGS + Closing Stock)

You may also be using one of the following methods for inventory valuation:

- FIFO: First in, first out inventory valuation is a common method of pushing out the inventory that entered the warehouse first. The first manufactured or purchased stock is sold off before the others. It uses the same disposition as supermarket stores, where you may observe that the oldest products are displayed up front. It is mainly used by sellers of perishable products.

- LIFO: As opposed to FIFO, the last in, first out method suggests selling off the newest inventory first. Auto dealers commonly use this method to lure customers in with new models and sell them off before the old ones.

- Weighted Average Method: The average cost of items purchased is used to calculate the COGS and ending inventory value. Many manufacturers use this technique of inventory valuation, so they can avoid differentiating between product batches.

Reasons You Should Calculate Opening Stock

Calculating opening stock helps in the estimation of various critical factors to ascertain your business performance. Its importance is listed in the points below:

Cost of Goods Sold

You can use the formula mentioned above to calculate COGS. However, to ascertain this, you should include unsold ending stock for prior accounting periods in the gross profit figures. Opening stock creates the opening balance of a new accounting period and forms the basis of COGS.

Gross Profit

Once you have determined the COGS, compare it with the revenue earned to find your gross profit margins. Equating COGS with sales tells you whether your operations brought you a profit or a loss.

Average Value of Inventory

This is an average of beginning and ending stock. It can be calculated as [opening inventory + ending inventory] / 2

Inventory Turnover

It measures how frequently you sell your inventory in a year and if you can replace it in a timely manner. Inventory turnover indicates the operational efficacy of a company. A slow turnover suggests weak sales and a quick turnover shows healthy sales figures but insufficient inventory. Most retailers with high volumes and low margins experience one of the highest inventory turnover rates. Here is the most commonly used formula:

Inventory Turnover = COGS / Average Value of Inventory

Although inventory turnover can be calculated by dividing COGS by sales, most analysts and businesses don’t use it. This is because sales figures include profit margins that can skew the inventory turnover figure.

7 Important Use Cases of Beginning Inventory in 2023

Recognising Inventory Management Disputes

A higher number of leftovers or a supply crunch signals inventory management disputes. Frequently evaluating the opening inventory can help identify these issues at the right time. More negligible beginning stock shows lapses in the merchandise ordered during the last period. Calculating opening stock helps highlight these issues, so you can take timely actions to restore balance.

Identifying Logistical Issues

Owning more or less inventory than forecasted inventory indicates supply chain gaps. As a result, a demand or supply mismatch could lead to logistical disruptions. Knowing the opening inventory balance at the beginning of every accounting period helps you ascertain the loopholes in the chain.

Spotting Inventory Shrinkage

Inventory shrinkage occurs due to a difference in the stock accounted for in the books and the actual quantity in the warehouse. It is a logistical nightmare for retailers and suppliers and occurs for various reasons. Damaged or stolen goods or human errors are the most common causes of shrinkage. Monitoring the beginning inventory level can highlight gaps in the figures and help prevent or reduce shrinkage.

Highlighting Demand Changes

Variations in the opening stock levels indicate changes in your business’ supply and demand. For instance, a sudden growth in sales leads to a reduced beginning stock and vice versa. So calculating the opening stock helps in understanding your business performance.

Controlling Your Taxable Revenue

Opening inventory helps determine the average stock level. Combined with sales forecasts done right, the opening inventory level can help you understand how much stock you need. Thus, you can decide when and how much to pre-order. This can also help you reduce your taxable income.

Analysing Your Business Performance

Opening stock is a current asset that forms a part of your working capital. It is to be held temporarily and assists in estimating the liquidity levels of a business. This can help you discern the current performance of your business and whether any changes need to be made.

Maintaining Statutory Compliance

The AS-2 and Ind AS-2 guidelines mandate disclosure of inventory levels of your company. Information like the carrying amount of inventory and the related expenses need to be revealed. Some of the stock-related data you need to provide are:

- Inventory accounting policies.

- Carrying amounts for all inventory stages, such as raw material, WIP and finished goods.

- The written-down amount of any inventory counted as an expense or a reversal of that amount and the conditions that led to it.

- The cost of inventory is counted as an expense, like COGS.

Conclusion: Optimize Your Opening Inventory With InventoryLogIQ

Inventory valuation deeply affects supply chain efficacy. And the stock levels decide the demand and supply gaps which influence your business performance. Numbers are everything for an enterprise; managing the inventory becomes critical for success if you deal with tangible products.

Your logistics and operational prowess can break down if the inventory is not managed correctly. The simple formula of opening stock tells you where you stand at the beginning of a new accounting period. Pay close attention to what the stock numbers say, as it determines how well you can meet customer expectations. Evaluating opening inventory is critical to deciding your expenses and the gross profit you earn in every cycle. It is a metric of your business’s success.

You can utilise skilled staff and technology to monitor inventory levels closely. Of course, inventory monitoring demands some time, but your products need it. If you require inventory monitoring or any other related task, InventoryLogIQ can be of assistance.

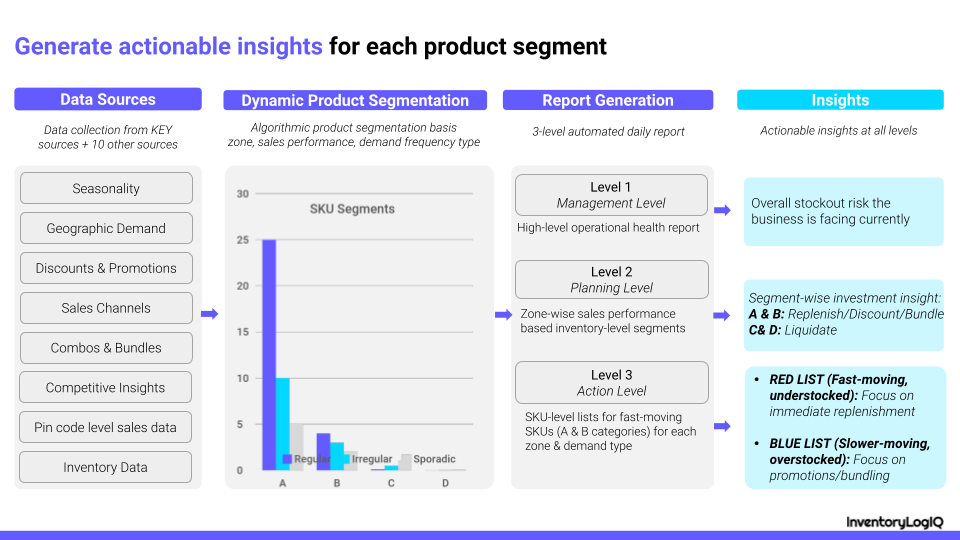

InventoryLogIQ is a rapidly growing inventory management platform that centralises the use of technology in all our core offerings. In addition to helping you monitor opening inventory levels, we also provide inventory and order management through our custom OMS, the ability to reduce your inventory costs and value-added services such as automated reorders, alerts in real-time and much more to ensure that your inventory will always be at its optimum levels and can be fulfilled efficiently and cost-effectively.

Suggested Read: What is Work in Process Inventory?