What is Inventory Carrying Cost? How To Calculate it and Save on Inventory Holding Costs in 2023?

Inventory is a non-liquid asset that must be transformed into cash through sales for firms that sell physical goods. A company’s profitability is determined by how well it controls this process. Inventory carrying cost is essential to monitor since it accounts for 15-30% of a company’s total inventory value. The expenses incurred by a corporation to retain inventory products for a long time before they are used to complete orders are referred to as inventory carrying costs.

A firm may limit carrying costs closer to 15% of total inventory and optimize earnings using effective inventory management techniques. However, inventory carrying costs can approach or surpass 30% of the complete inventory and eat into profitability if inventory control is inadequate. Understanding and measuring your business’s carrying costs and implementing optimal inventory control procedures are necessary to achieve the former.

- What is Inventory Carrying Cost?

- Why do Businesses End Up Spending on Inventory Carrying Costs?

- What is a Reasonable Annual Carrying Cost for Inventory?

- Why Should You Calculate Inventory Carrying Cost in 2023?

- The Main Components of Inventory Carrying Cost

- Inventory Carrying Cost Formula and Calculation

- 5 Reasons a Company Holds Inventory

- 5 Ways Businesses Fail to Lower Carrying Costs in 2023

- 10 Ways to Reduce Inventory Carrying Costs in 2023

- Keep an Eye Out for Order Minimums

- Determine Reorder Points

- Reduce Supplier Lead Time

- Get Rid of Obsolete Stock

- Improve Your Warehouse’s Layout

- Implement a Just-in-Time Inventory (JIT) System

- Use Consignment Inventory

- Utilize Precise Demand Forecasting

- Consider Implementing an Economic Order Quantity System

- Try To Keep Your inventory From Being Overstocked or Understocked

- How Does Inventory Management Software Reduce Inventory Carrying Cost?

- Conclusion: How Your Business Can Benefit From Lower Inventory Holding Costs With InventoryLogIQ in 2023

- Inventory Carrying Cost: FAQs

What is Inventory Carrying Cost?

The sum of all costs involved with keeping inventory or goods in storage or warehouse is known as inventory carrying cost, also inventory holding cost or simply “carrying cost.” It covers both hard and soft expenditures, such as your product investment, physical warehouse or storage space, transportation expenses, and distribution fees, taxes, insurance, and the employees required to handle the goods. Inventory carrying expenses are a fact of life for everyone who sells a tangible commodity. For example, selling a physical item will need to be retained as inventory at some point before reaching the end customer.

Inventory carrying costs are an essential metric to use when analyzing whether or not your company is lean. For example, high carrying costs might indicate that your company has more inventory on hand than it needs to meet demand, that you need to change the frequency with which you make orders with manufacturers or distributors, or that you could improve your stock movement. Capital expenses, storage costs, service costs, and inventory risk costs are factors that add up to get inventory carrying costs.

Capital expenditures include money spent on things and any interest and fees incurred if the goods were purchased with a loan. Storage expenditures, like a store/warehouse mortgage, might be set or variable, much like labour, utilities, and administrative costs. Service charges include taxes, insurance, and inventory management software, and inventory risk includes inventory shrinkage, depreciation and product obsolescence.

Why do Businesses End Up Spending on Inventory Carrying Costs?

Businesses suffer inventory carrying costs as a result of the necessity to have goods on hand because of the following reasons:

- Anticipation Inventory, Safety Stock and Buffer Stock: This is the total amount of merchandise maintained on hand to adjust for supply and demand changes.

- In-transit Inventory: All inventory is in transit from one point in the supply chain to another.

- Dead Stock: Dead Stock is stock that is no longer available. Stock that has reached the point of expiry, obsolescence, or any other quality or demand decline makes it unusable.

- Cycled Inventory: Inventory that is maintained on hand to meet regular sales orders.

What is a Reasonable Annual Carrying Cost for Inventory?

The average inventory carrying cost is determined by the industry and the company’s size. Therefore, the cost of maintaining inventory varies greatly depending on the business. However, we can provide some rough averages. A frequently acknowledged optimal yearly inventory carrying cost, according to a 2018 APICS research, is 15–25 per cent. However, depending on the sector and the organization, annual inventory carrying costs might range from 18 per cent to 75 per cent.

Why Should You Calculate Inventory Carrying Cost in 2023?

According to ASCM, more than 65% of businesses do not calculate inventory carrying costs and instead rely on estimations. Inventory holding costs may account for up to a quarter of total inventory expenditures. As a result, they can impact a company’s overall financial health. For example, it may have cash flow issues if a company cannot quantify the cost of maintaining goods on hand, such as through an inventory or stock control system.

A firm might miss out on a lucrative investment or expansion opportunity because it has too much money locked up in inventory—without its management recognizing how much carrying expenses are holding it back. Calculating inventory costs is also essential for the following reasons:

Production Schedules

Inventory carrying costs assist your company in rethinking and planning production for the best advantage. For example, if you know how much you spend on inventory storage, you can plan to arrange the manufacturing process and store it appropriately. You can only maintain a certain amount of things in stock that can be created rapidly. Similarly, you might stockpile more of the products that take longer to make. In this manner, the warehouse space is not taken up by everything. At any moment, only essential items with lower inventory carrying costs are held in the warehouse.

Accounting

Knowing your inventory carrying costs makes you less likely to run into cash flow problems. To guarantee that you know your working capital, you must understand the cash flow. Cash flow analysis can provide information about a company’s liquidity. Carrying expenses for inventory are also high costs that many organizations overlook. This is why assessing the expenses is critical: if you know the exact price of retaining inventory, you can take steps to reduce those costs while increasing earnings. It will also guarantee that you can create more accurate financial accounts.

Profits

Inventory carrying costs allow you to determine the value of each item. Because you know the price of storing inventory and how much you collect when you sell it, this statistic may help you estimate the profitability of each item. Knowing how lucrative your inventory is can help you choose how much inventory to maintain and whether to keep additional stock. It also allows you to consider ways to increase earnings, allowing you to boost profits.

The Main Components of Inventory Carrying Cost

Many expenses enter the equation of inventory holding costs, and when added together, they amount to a popular way for firms to lose money. Let’s have a look at each component inventory holding cost includes:

Opportunity Cost

One of the essential components of inventory holding costs is opportunity cost. When you spend more money on inventory than is required, you miss other chances. That money might be spent on things like better marketing to generate more leads and hiring more staff to increase efficiency, among other things. If you believe you are overspending on inventory storage, consider how you may save money.

Operational Cost

Administrative expenditures, which are included in inventory carrying costs, account for a significant portion of the total. It covers things like equipment depreciation, cleaning, and transportation. When you have a lot of inventory, your administrative costs will likely rise since you’ll need more room to keep it all and manage it. However, to make the most of the space provided, you must keep administrative expenditures to a minimum.

Capital Cost

One of the most expensive components of inventory carrying costs is the cost of capital. The interest and product price, as well as any additional charges, are included in the cost of capital. Businesses may reduce capital costs by precisely predicting with the right technology and structuring their purchases for maximum efficiency. To keep expenses down, try to negotiate pricing with your long-term suppliers.

Insurance and Tax

When you have more merchandise, your insurance and taxes are more significant. This indicates that it’s advisable to maintain a small number of goods on hand to fulfil demand. Therefore, the first approach is to prioritize items constantly in demand and store them in the warehouse, followed by the next most in-demand product. You may save money on insurance and taxes, lowering inventory carrying costs and improving cash flow.

Employees’ Cost

Another expense that is included when determining inventory carrying costs is labour. You’ll need workers to organize your items in the warehouse and transport them to various locations according to the specifications. Automation can help you save money on labour by bringing the most important objects closer to your grasp. Additionally, you can ensure the warehouses are designed for high productivity.

Problems With Innovation

There isn’t enough time to think about innovation when you’re continuously preoccupied with your inventory. Your clients may be asking for a certain modification, but you won’t be able to focus on it if you’re just focusing on the inventory you currently have. You may lose valued consumers as a result of this. One approach to guarantee you’re concentrating on product innovation is to make sure your stock levels are optimized.

Storage Cost

It’s also important to consider where you store your inventory because products take up precious warehouse space, which you’ll have to pay for. The storage technique is particularly important since larger storage boxes and bins take up more room, resulting in higher overall storage expenses. If you have a warehouse, reconsider how you keep your items so that they are easy to find and fit snugly without taking up too much room.

Handling Cost

Many costs are covered by product handling. For example, the shipping label, product damage, and machinery are all included. When attempting to reduce handling expenses, consider if you really need all of the machinery you now have. You should consider if all of the equipment is required or whether you can get by with only some of it. You may reduce the inventory carrying cost by reducing handling costs.

Obsolete Inventory Cost

It’s possible that your merchandise will become obsolete at some point. That is, when you sell it, it has no value since it is no longer helpful. When this happens, you’ll need to get rid of it, which will come at a cost. If you don’t want to end yourself in this situation, sell your merchandise while it’s still valued. This can be accomplished through discounts or donations, ensuring that inventory does not go to waste.

Shrinkage

Shrinkage occurs when merchandise is lost after it has been purchased but before it is sent to the consumer. This might happen if there has been a theft or if the merchandise has been damaged in transit. When you have more stock, there is more likely to be shrinkage. You have the option of firing the employees who stole the stock. If inventory shrinkage is caused by damage, make sure the items are handled with care and transported with incorrect packing.

Inventory Carrying Cost Formula and Calculation

There are two methods for calculating your company’s holding expenses:

Formula 1

Inventory Carrying Cost = Total Annual Inventory Value divided by 4

Let’s imagine a company’s inventory is worth $100,000 every year.

The carrying cost of inventory is $100,000/4 = $25,000.

Retail or gross profit can be used to calculate your ending inventory.

This method will provide you with a general approximation of your company’s carrying cost. It is preferable to utilize the second calculating approach for a more precise result.

Formula 2

Carrying Cost (percentage) = Inventory Holding Sum / Total Value of Inventory x 100

However, you’ll need the inventory holding total to use the formula.

Calculation of Inventory Carrying Costs

Inventory Holding Sum = Capital Costs + Warehousing Costs + Inventory Costs + Opportunity Costs

This is the proportion of total inventory value divided by total inventory value multiplied by 100 to get the inventory carrying cost percentage.

Let’s take a look at how it all fits together using an inventory carrying cost estimate as an example.

Let’s say the Annual average inventory cost is $1 million.

Step 1: Compile a List of Inventory Holding Totals

Costs of Capital: $20,000

Costs of Warehousing: $120,000

Cost of Inventory: $75,000

Opportunity Costs: $25,000

Step 2: Determine the Amount of Inventory You Have on Hand

Inventory Holding Sum = Capital Costs + Warehousing Costs + Inventory Costs + Opportunity Costs

Inventory Holding Sum = $20,000 + $120,000 + $75,000 + $25,000

Inventory on hand is $240,000

Step 3: Calculate Inventory Carrying Costs

Inventory Holding Sum / Total Value of Inventory x 100 = Carrying Cost (percentage)

Carrying Cost (percentage) = $240,000 divided by $1,000,000 multiplied by 100

Carrying Cost (percentage) = 24%

5 Reasons a Company Holds Inventory

It’s not easy to get the perfect inventory balance. Many businesses believe that having too many things is preferable to running out and perhaps losing a transaction or damaging a client relationship. Here are a few other reasons why companies keep too much stock on hand, driving up their inventory carrying costs:

Safety Stock

Stocking only enough stock to meet predicted demand might be dangerous. That’s why most businesses keep some safety stock, or excess inventory, on hand to deal with unforeseen circumstances like an increase in demand, a supplier delay, or a broken shipment. It’s a good idea to have some safety stock on hand for popular commodities but do so sparingly because too much safety stock will result in needlessly high holding costs.

Demands That Are Cyclical or Seasonal

Retail inventory management is especially crucial since many businesses—particularly retailers—earn the majority of their yearly income in only a few months. In the months leading up to the winter holidays, and electronics merchant may notice a spike in order volume, but an inflatable pool toy maker may conduct most of its business in the spring and early summer. These businesses may build up big inventory reserves before the busy season begins in order to be prepared for that critical stretch.

Inventory Cycles

A corporation purchases cycle inventory after making sales estimates. This is the stock necessary to meet predicted demand for particular items; unlike safety stock, it is not intended to cover the unexpected. To keep up with consumer demand and produce sales, any products-based firm needs cycle inventory, also known as working stock. To store the proper quantity of cycle inventory, accurate predictions and cycle counting are essential.

Inventory While in Transit

Products that have been purchased but not yet received are referred to as in-transit inventory. Lead periods might be many months, depending on where a supplier is situated and the type of goods. Thus inventory could remain in transit for a lengthy time. Businesses must account for these commodities in transit when planning future purchases, but because they aren’t yet in the warehouse, it’s easy to ignore them. This is especially true if you don’t have a system in place to track the progress of all purchase orders.

Obsolete Inventory

Obsolete inventory is sometimes known as “dead inventory.” These are things that a business no longer feels it can sell and is generally written off as a loss. Dead inventory may sit in a distribution centre or back room, quietly and steadily increasing inventory carrying costs without the knowledge of executives.

5 Ways Businesses Fail to Lower Carrying Costs in 2023

There are several main sources of needlessly high holding costs, and any of them might make it difficult for firms to reduce this cost. Look at these potential difficulties if your inventory expenses appear exorbitant and you’re not sure why:

Using Excel and Old-School Techniques

Because of their limited usefulness and lack of automation, spreadsheets soon become obsolete for businesses. Inventory reports generated using Excel spreadsheets, paper records, or other archaic tracking techniques are frequently erroneous and cannot be updated in real-time.

And if a company doesn’t know what it already has, it’s more likely to overspend or buy the incorrect things. Rather than strategy and evidence, decisions are governed by gut instinct or best estimates.

Demand Forecasting That Isn’t Up To Date

High holding costs are frequently caused by poor inventory demand predictions. If a corporation bases its estimates on faulty data, it may anticipate a surge in demand for a certain SKU and stockpile inventory, only to have sales fall significantly short of expectations. It may also make the mistake of assuming that just because a product was a great seller last quarter, it will continue to fly off the shelves for the following two. In either case, the corporation is left with a lot of surplus inventory that takes up precious space and costs money that might be spent elsewhere. Consider the term opportunity cost mentioned above.

Failure to Recognize Trends

Not only does proper inventory and production planning require correct data, but it also necessitates individuals who can successfully evaluate and understand that data. Employees must be able to see patterns in data and evaluate the implications. For example, if a purchasing manager fails to notice that sales for numerous goods fell off in the final month of the third quarter, he may make a large order for the fourth quarter, resulting in outdated inventory. Leaders must also consider how industry developments or larger economic movements may impact demand for their products.

Low Inventory Turnover Ratio and Overstocking

The inventory turnover ratio is a crucial indicator that indicates how frequently specific goods are sold and refilled over the course of a year. Purchasing choices are based on this ratio. When an organization has a poor turnover ratio for too many items, it faces high inventory carrying costs and, eventually, outdated inventory. This results in an overcrowded warehouse full of merchandise that is neither moving fast nor as valuable as it previously was.

Flawed Inventory Management/Order Fulfillment Processes

Those without a thorough inventory management plan, including those who utilize Excel or other old systems, will over-order to protect themselves. It’s inescapable without a system that gives real-time visibility down to the SKU level and shows reorder points based on lead times and current demand.

Inefficient eCommerce fulfillment methods, however, can drive up labour expenses, while bad warehouse management systems or architecture or storage procedures can drive up storage costs and make it easier to ignore current inventory. As a result, there is outmoded inventory, depreciation, and increased insurance, tax, and administrative expenditures.

10 Ways to Reduce Inventory Carrying Costs in 2023

Companies may reduce inventory carrying costs in a variety of methods, some of which take little time and effort. The following are some smart ways to save money while keeping things in stock:

Keep an Eye Out for Order Minimums

A supplier’s minimum order quantity (MOQ) is the smallest order size that they will accept. Lowering the MOQ implies you’ll have less stock on hand but will be able to purchase more frequently, lowering your inventory carrying costs. Smaller, more regular orders allow your company to be more flexible when demand changes. Developing strategic partnerships with your main suppliers is the greatest way to lower MOQ. When suppliers perceive that you are serious about building a long-term, mutually beneficial business relationship with them, it is simpler to negotiate cheaper orders.

If you know another business owner who needs the same stock, you may pool your funds and divide the shares among yourselves. Another option to lower your MOQs is to offer to pay your supplier a little more for less inventory, which might save you money in the long run and lower your inventory costs.

Determine Reorder Points

Your inventory will not fall below your safety stock levels if you choose an optimal reorder point. It helps you save money on storage by notifying you when you need to get extra goods from your vendors. You will prevent shortage expenses, which is the danger of losing a client order owing to low inventory levels if you use a reorder point. You’ll know when it’s time to order additional shipments if you know what your reorder point is.

It should be noted that as your company expands, this will get more difficult, as the reorder point for each product variety is different. Knowing your reorder point can assist you in avoiding ordering too much and risking obsolescence, as well as ordering too little and risking stock-outs, lowering your inventory carrying costs

Reduce Supplier Lead Time

The lead time in inventory management is the time it takes from the time an inventory order is placed until the products are delivered by the supplier. In other words, it’s time it takes a supplier to complete an order. When supplier lead times are long, you’ll need to have additional safety stock on hand in your warehouses to ensure that all of your customers’ orders are fulfilled. As a result, you’ll have higher holding expenses because you’ll need to keep more goods.

You may reduce inventory levels and, as a result, inventory costs by shortening supplier lead times. Developing solid ties with your suppliers is the best way to achieve this. Remember to emphasize that if they can minimize the lead time, you’ll be placing more orders more frequently, which should benefit you. When it comes to replenishing goods, you may gain additional flexibility by negotiating shorter supplier wait times. The advantage is that it allows you to keep less inventory, which lowers your carrying costs and eliminates the long-term risk of retaining things that may become outdated.

You’ll need to adjust your order size and frequency to achieve this efficiently. Demand forecasting – the use of previous sales data to produce an estimate of a projected prediction of customer demand – is one approach to do this. It helps you to fulfil demand while reducing holding costs by not carrying too much inventory. Get rid of any merchandise that is no longer in use. Obsolete inventory is a problem that many internet companies face.

When you overestimate a product’s potential, you risk having a large number of goods that don’t sell owing to a lack of client desire. The drawback is that it raises your holding expenses because you’re maintaining merchandise that can’t be sold and takes up precious warehouse space that might be better utilized. Monitoring the product life cycles of each of your items and making better predictions when purchasing are two ways to mitigate this issue.

Get Rid of Obsolete Stock

Obsolete inventory is a problem that many internet companies face. When you overestimate a product’s potential, you risk having a large number of goods that don’t sell owing to a lack of client desire. The drawback is that it raises your holding expenses because you’re maintaining merchandise that can’t be sold and takes up precious warehouse space that might be better utilized.

Monitoring the product life cycles of each of your items and making better predictions when purchasing are two ways to mitigate this issue and reduce inventory carrying costs. After you’ve gotten rid of the outmoded stock, you’ll want to keep it from resurfacing.

You may achieve this by changing your demand forecasting depending on predicted future sales, ensuring that you purchase the right amount of stock. This allows you to significantly lower your inventory carrying costs while also ensuring that you are neither overstocking nor understocking.

Improve Your Warehouse’s Layout

A structured warehouse allows you to arrange your products more effectively and enhance the general architecture of your facility, which lowers your carrying expenses. A chaotic warehouse, on the other hand, is more likely to have misplaced or damaged inventory, as well as higher travel costs, which is especially true in big warehouses where workers must traverse thousands of square feet for a single product. Putting your high-volume products up front in the staging area is the most efficient way to arrange your warehouse, as it will streamline your pick, pack, and ship process.

Determine your fast-moving products by analyzing your inventory flow-through rates (or things that demand regular replenishment). By identifying these factors, you can prioritize putaway (the process of removing products from a receiving shipment and storing them in your warehouse) and choose warehouse sites that bring fast-moving commodities closer to staging areas. You may cut travel time and other related carrying expenses like forklift truck maintenance, labour hours, and more by strategically organizing your warehouse.

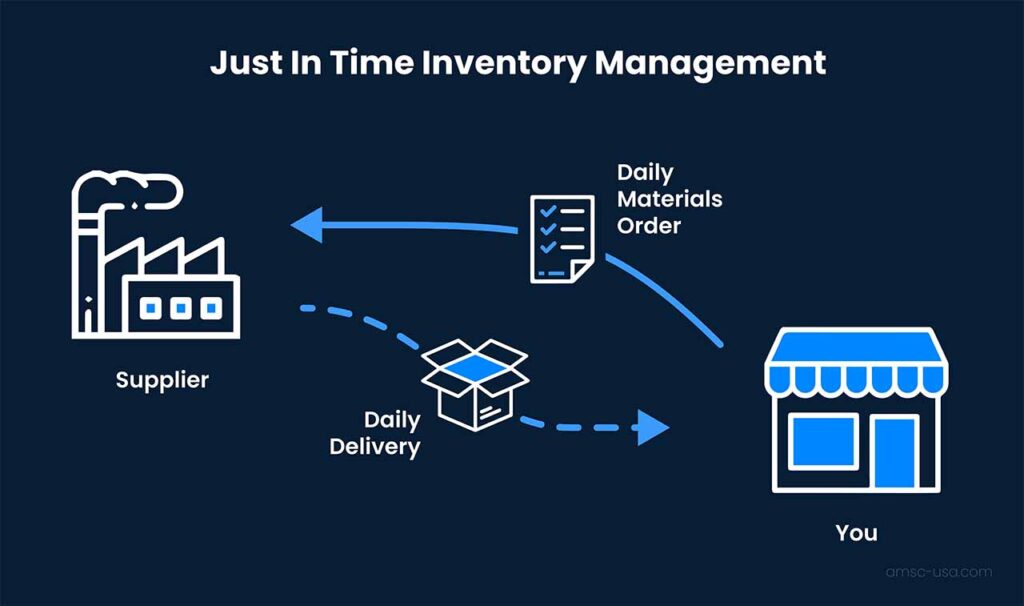

Implement a Just-in-Time Inventory (JIT) System

JIT inventory management refers to having the correct items and materials in the right place at the right time, as well as the proper number of materials to manufacture a product. To put it another way, JIT is a strategy of holding practically minimal inventory in your warehouse and instead ordering what you need as soon as you need it. It’s a type of lean manufacturing that reduces inventory costs by ordering things and supplies just when they’re needed rather than weeks or months ahead of time.

Furthermore, because you will only be storing a small amount of merchandise, you will not require a huge warehouse, lowering your eCommerce warehousing expenditures. JIT isn’t ideal for every retail organization, but it is a tried and true approach to drastically decrease inventory holding expenses.

Use Consignment Inventory

You may use consignment inventory to leave a portion of your inventory with your supplier until it is sold. As a result, your inventory levels are lower, and your inventory costs are reduced. Furthermore, because online sellers who use consignment inventory don’t buy it until it’s sold, unsold items can be returned.

In general, things supplied under the consignment model are seasonal or perishable in nature. When client demand is unclear, it is extremely helpful to online sellers. Furthermore, by carrying the product on consignment, the online merchant assumes a lower financial risk because the commodity is not paid for until it is sold.

Utilize Precise Demand Forecasting

Using precise demand forecasting is another approach for lowering your inventory carrying costs. Real-time monitoring of your business helps you know when you’re running low on stock and need to purchase more. You may also figure out what your best-selling things are, as well as what your worst-selling items are and what demand patterns are.

In other words, using accurate information to estimate demand allows you to buy exactly enough inventory to meet demand throughout the year, lowering your overall inventory costs by avoiding overstocking or understocking your warehouse. Once you’ve identified your slow-moving merchandise, you can concentrate on what’s selling — the trick is to use tools to measure data correctly.

Predictive data analysis assists you in inventory forecasting the right quantity of inventory based on prior months’ data, allowing you to make better business decisions in the future. You won’t order too much and run the risk of running out of stock this way. Furthermore, constantly monitoring sales patterns allows your retail organization to minimize the amount of extra stock it carries, lowering storage and handling expenses.

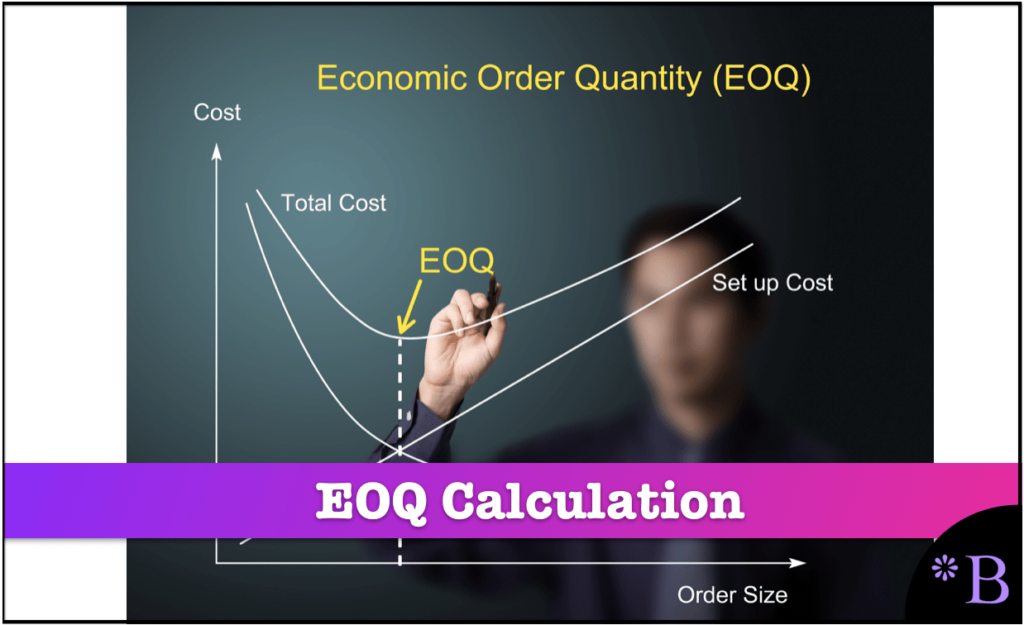

Consider Implementing an Economic Order Quantity System

Ordering a large number of items each month will reduce your order frequency and cost, but it will raise the amount of inventory you have on hand and your carrying expenses. Making modest but regular product orders throughout the month, on the other hand, will reduce your stored inventory and holding expenses while increasing your order frequency and cost.

The Economic Order Quantity (EOQ) approach can be used to balance both of these results. The EOQ is the number of units a firm should add to its inventory with each order in order to reduce overall inventory carrying costs. The EOQ method is most commonly used as part of a continuous review inventory system, in which inventory levels are constantly checked, and a predetermined amount is purchased if a product’s stock level exceeds a certain reorder threshold.

Try To Keep Your inventory From Being Overstocked or Understocked

Overstocking occurs when you purchase more merchandise than you can sell, lowering your profitability. This occurs because you’re investing in a stock that you won’t be able to recoup through sales. Because you’re storing stuff that can’t be sold, your holding expenses will rise. By anticipating sales based on previous data, you may limit the risks of overstocking and understocking — and thereby save your holding costs.

Based on how successfully your sales went in a prior period (e.g. monthly), you may guarantee that you will keep more precise stock levels in the future. You may also set up automated notifications to notify you when your stock reaches a specific level, letting you know when it’s time to restock. An inventory and order management system can help you do this.

How Does Inventory Management Software Reduce Inventory Carrying Cost?

Investing in an inventory management solution is a strong way for organizations to decrease inventory carrying costs. This programme provides a variety of options for inventory optimisation, optimizing inventory levels and lowering all of the above-mentioned costs. The visibility that an inventory management system provides is invaluable to any goods organization, as it allows buying, operations, and supply chain experts to make more informed decisions. Not only can the solution manage current stock levels, but it can also track the status of any outstanding purchases and client orders.

There will be no more “forgetting” about merchandise in a shipping container en route to your facility. This system will also provide standard receiving, putaway, and fulfillment procedures, ensuring that each item can be tracked from the time it reaches your warehouse to the time it is delivered to the consumer. Inventory management software allows businesses to be proactive, allowing them to change purchase orders, sales strategy, warehouse layouts, and other factors to solve issues before they become costly.

An inventory management solution’s reporting features are also quite useful. For example, a company may see their inventory turn or sales data for a certain product category or SKU at any moment. It can keep track of how much money is lost to depreciation or spent on taxes and insurance over the course of a quarter or year.

This information provides decision-makers with the information they need to keep inventory carrying costs under control. A buying manager could look at the sell-through rate for the previous month and decide to cancel a few forthcoming orders, redirecting the funds to a fast shipment for an item that has seen sales treble in the last two weeks. This data also aids finance and operational management in developing more precise estimates.

Leaders should be very cautious about the things they maintain in their stores and warehouses, as well as the quantity they keep. In the end, the more strategic an organization’s inventory management is, the cheaper its holding costs will be. In the end, avoiding out-of-stock and overstock situations requires ongoing balance.

Even with best-in-class forecasting skills, getting inventory planning just right is nearly hard. However, tying an inventory management system to a bigger ERP management platform is a vital step in lowering holding inventory costs since it allows for improved forecasting and provides the real-time information that any products-based company requires to make informed inventory choices.

Conclusion: How Your Business Can Benefit From Lower Inventory Holding Costs With InventoryLogIQ in 2023

Don’t leave your firm in the dark when it comes to the expense of inventory storage. You may detect and reduce inventory inefficiencies and develop benchmarks to guide future business choices by calculating inventory carrying costs on a regular basis. More favourable profit margins and increased cash flow are aided by lower carrying expenses. This money may then be re-invested in your company to help it develop, with the advantages being passed on to your consumers. Controlling inventory holding costs is good for your company’s financial health and may help you improve a variety of elements. Reducing inventory carrying costs

InventoryLogIQ is a Bangalore-based company that specialises in the intelligent management of your inventory. Listed below are some of the key benefits of partnering with InventoryLogIQ:

- Increases Operational Flexibility: We will help you quickly adapt to constant industry changes.

- Boosts Sales and Prevent Stock Shortages: We will help you concentrate on the products that are selling and employ auto-replenishment to prevent stockouts situations.

- Avoids Bloated Inventory: We assist you in flagging slow-moving, overstocked items to prevent inventory dilation.

- Simplifies Inventory Management: We provide automatic parameter settings so every task will be straightforward to accomplish.