Ending Inventory Guide: Definition, Importance, Formula and Methods to Calculate Closing Inventory in 2023

Every retail business, be it eCommerce, SMEs, or those following a multi-channel approach, need to have a clear idea of closing stock. The ending inventory of the sellable stock in the warehouse is vital for businesses to have visibility of sales, understand the value of the inventory, changes to be made in inventory forecasting and stock levels, etc. The closing inventory is a crucial metric for better inventory forecasting, understanding what items should be stocked more, which items don’t get as many sales, and how the business needs to reassess strategies to remain profitable.

- What is Ending Inventory?

- What is the Need to Calculate Ending Inventory?

- The Formula for Ending Inventory Calculation Using the Ending Inventory Formula

- 3 Different Methods of Closing Inventory Calculation With Examples in 2023

- Conclusion: How Can InventoryLogIQ Help Manage Closing Inventory for Your eCommerce Businesses in 2023?

- Ending inventory: FAQs

What is Ending Inventory?

At the end of an accounting period, the ending inventory is the stock value of finished products in sellable condition. The closing stock includes mentioned assets on the balance sheet. Taking note of the ending inventory is necessary for accurately calculating taxes and estimating the total business value. Closing inventory calculates the total value of the good, not the inventory volume or the number of units available.

What is the Need to Calculate Ending Inventory?

Calculating ending stock is important to identify what products are fast selling and need greater importance and which items take a longer time to sell. By understanding which products take longer to be sold, businesses can improve their forecasting and production strategies and decide if their production or sourcing volumes need to be shortened or lengthened accordingly. Visibility on closing inventory is important to:

Match Recorded Inventory with Actual Stock Levels

This provides insight into any stock discrepancies between the recorded and physical inventory in the warehouse/fulfilment centers and matches it with the sales made. If the physical inventory is less than what is recorded, it is known as ‘inventory shrinkage‘. The cause for this discrepancy could be accounting errors, theft, or various other concerns.

Know the Revenue Being Generated

Calculating the business’s net income becomes easier with the starting inventory and ending stock. This can also help provide clarity on the pricing strategy. Suppose the recorded inventory and physical inventory costs don’t match up, it can indicate that the sold items are not profitable as the initial purchase or production will be more expensive than the sale price. You can see how to calculate average revenue here.

Improve Forecasting and Inventory Management

When you calculate the closing stock, it considers the starting inventory during the beginning of the accounting period. This, of course, is a cycle. Having the closing stock details paints a clear picture of which items sell better than others, the ideal volume of items in the inventory, and how soon items need to be replenished. This also improves the forecasting capabilities for future inventories, discounts etc.

The Formula for Ending Inventory Calculation Using the Ending Inventory Formula

It is important to calculate the closing inventory correctly to keep taxes and accounting in check. For every new accounting period, the starting inventory is calculated from the closing inventory of the previous period. This makes it even more crucial to have the right data to achieve better inventory management. Having accurate calculations also ensures no unexpected shortage or shrinkage in the physical inventory compared to the recorded inventory. The ending inventory calculation formula is:

Ending Inventory = (Beginning Inventory + Net Purchases) – Cost of Goods Sold (COGS)

Here’s what each term means:

- Beginning inventory is the closing inventory from the last accounting period.

- Net purchases include all items that have been additionally bought and added to the inventory.

- Cost of goods is the total costs involved in sourcing, procuring, manufacturing and getting the finished product ready for sale.

Various variables come into play. We arrive at different values based on the calculation method when the ending inventory is calculated. Note that only the estimated value of the inventory changes as the units in hand is constant. You will find these 3 methods for ending inventory calculation in the following section.

3 Different Methods of Closing Inventory Calculation With Examples in 2023

A physical inventory count is the easiest approach for closing stock calculation. However, doing a physical check may not be feasible, especially if you have a huge volume of inventory to track. There are a few different ways to calculate the closing inventory. Because there are various methods for calculating EI, it’s advisable to stay with one every year to minimise discrepancies in subsequent reports. Let’s see the different ways to calculate closing inventory:

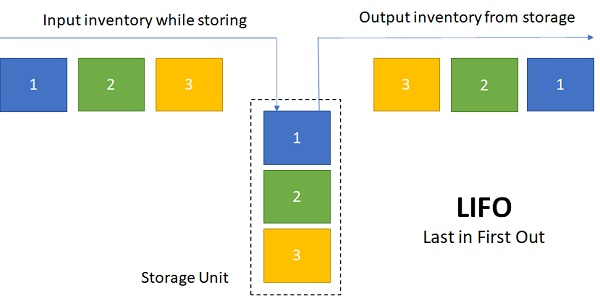

Last in, First Out (LIFO)

This method of inventory calculation considers that the most recent stocks were sold first. The older stocks become part of the closing inventory and the newest inventory is noted as the COGS. For example, you purchased 100 books at Rs.5 per unit, making beginning inventory (100×5=500). When the books needed to be replenished after sales, the per-unit price increased to Rs. 7. During the accounting period, let’s assume that 125 books were sold.

In this method, your cost of purchasing the latest inventory was higher than the older stock. So, COGS will be (100×7=700), which is the cost of purchasing the replenishment stocks + (25×5 =125) which will be the additional 25 units you sold from the old stock. This comes up to Rs.825. After using the ending inventory formula is:

Ending Inventory = Rs.500 (Beginning Inventory) + Rs.700 (Net Purchases) – Rs.875 (COGS)

The value comes up to Rs.325.

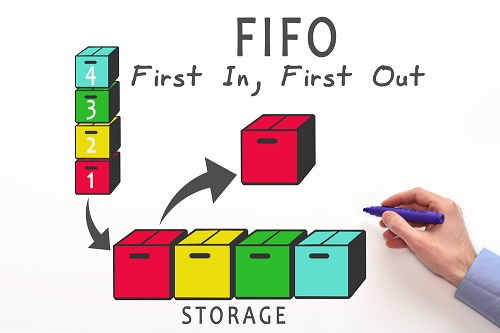

First in, First Out (FIFO)

This second tracking method, FIFO calculates by assuming that the oldest inventory gets sold first. So, the older stocks become part of COGS, and the newest inventory is added as ending inventory. For example, you purchased 100 books at Rs.5 per unit. During replenishment, the per-unit price increased to Rs. 7. During the accounting period, let’s assume that 125 books were sold.

So, COGS will be (100×5=500), which is the cost of purchasing the replenishment stocks + (25×7 =175) which will be the additional 25 units you sold from the new stock. This comes up to Rs.675. After using the ending inventory formula:

Ending Inventory = Rs.500 (Beginning Inventory) + Rs.700 (Net Purchases) – Rs.675 (COGS)

The value comes up to Rs.525.

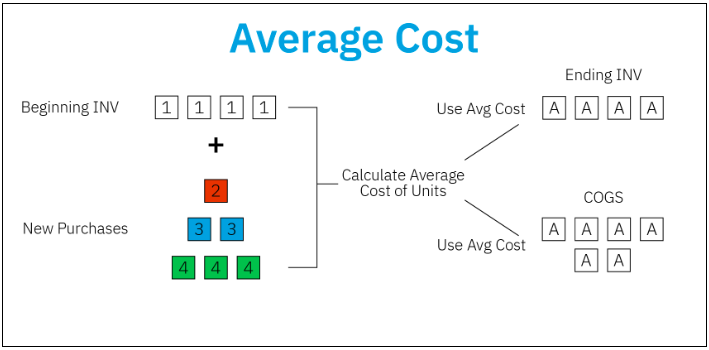

Weighted Average Cost (WAC)

This calculation method takes COGS as an average of the cost of inventory purchased during the accounting period and divides it by the total units in hand. For WAC, all inventory units are assigned the same value. For example, you purchased 100 books at Rs.5 per unit. During the replenishment of the next 100 books, the per-unit price increased to Rs. 7. During the accounting period, let’s assume that 125 books were sold.

For WAC, the total cost of both orders will be added (500+700=1200) and will be divided by the total number of units in hand (200). This gets the price per SKU as (1200/200), which is Rs. 6. So, COGS will be (125×6=Rs. 750), the cost of the weighted average of a single SKU x the total units sold. After using the ending inventory formula:

Ending Inventory = Rs.500 (Beginning Inventory) + Rs.700 (Net Purchases) – Rs.750 (COGS)

The value comes up to Rs.450.

Conclusion: How Can InventoryLogIQ Help Manage Closing Inventory for Your eCommerce Businesses in 2023?

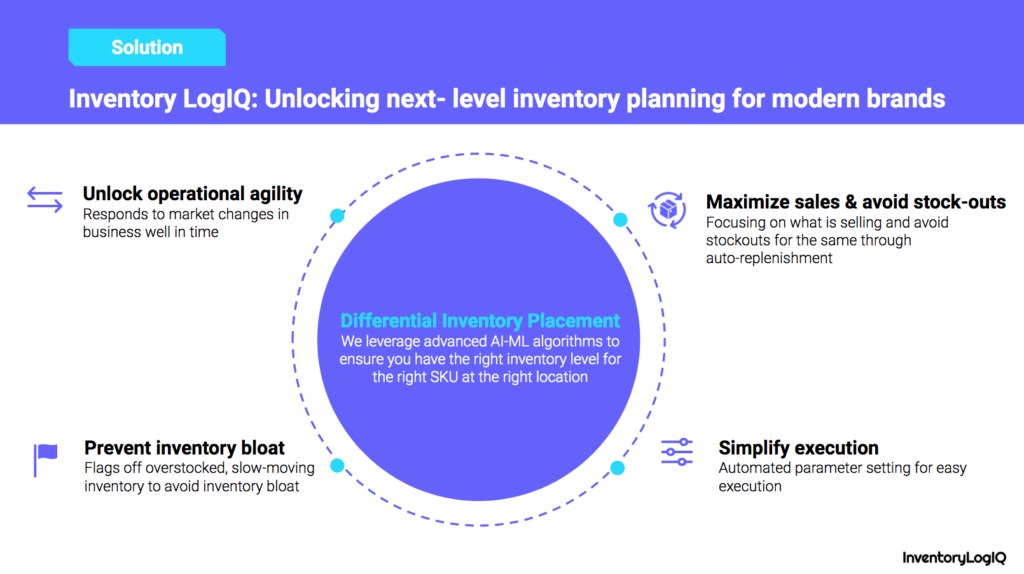

Ending inventory is an important figure for businesses to track, as it is used to calculate the cost of goods sold, which is a key component in determining a company’s profitability. A company’s closing stock can be affected by a variety of factors, such as changes in demand, production delays, or supply chain disruptions. Understanding and calculating closing stock are critical to your company’s success. However, the process might be complicated, which is where technology-enable inventory management companies like InventoryLogIQ can help. When the time comes to file business taxes, having the correct inventory management solution will save you a lot of time and trouble. Some of the benefits of partnering with InventoryLogIQ to manage your ending inventory include:

- Managing inventory levels, order data and billing

- Flexible scaling based on seasonality, order velocity and other factors

- Easy to view dashboards for orders, inventory and returns

- Seamless integration and collation of data from warehouses and retail outlets using our custom OMS

- Real-time insights to identify mishaps and promptly fix problems

With a fulfillment company like InventoryLogIQ, there’s no need to invest in a separate OMS, inventory management software or tracking tools. We offer end-to-end inventory management services by combining network, technology and knowledge. With a centralised platform for everything related to inventory management, InventoryLogIQ manages the entire range of complex operations, such as inbound functions like scanning and quality checks, accurate demand predictions, automated order replenishment and inventory management across all channels, for a delightful experience and zero to minimal supply chain leakages.

Suggested Read: What is Work in Process Inventory?