What is Work in Process Inventory? Definition, Calculations, Importance and Optimization Techniques in 2023

Inventory distortion costs the global economy an estimated $1.1 trillion, including inventory shrinkage, stockouts, and overstock. The quantity of waste created by system inefficiencies is simply mind-boggling. It is nearly equal to the gross domestic product (GDP) of the whole nation of Australia. It is crucial to account for raw materials and completed items, and each firm must account for the products used in the production process.

Ensuring that no raw resources are idle is another benefit of calculating work in process inventory, which indirectly helps to reduce the waste produced, encountering the extra revenues lost during manufacturing. For most businesses and shops, recovering even a small portion of that loss may completely alter their course. From here on, this article will explain what work in process inventory is, its importance, and how to calculate work in process?

- What is Work in Process Inventory?

- Comparing Work in Progress and Work in Process Inventory

- Importance of Work in Process Inventory

- The Importance of Calculating Accurate Work in Process Accounting

- Terms and Formulas to Know Before Calculating WIP Inventory

- How to Calculate Work In Process inventory?

- How to Cut Down Your Work in Process Inventory in 2023

- How to Improve Work in Process Inventory Flow in 2023?

- Conclusion: How InventoryLogIQ Can Help You to Optimize Your Inventory Management With WIP Inventory

- Work in Process Inventory: FAQs

What is Work in Process Inventory?

Work in process or WIP inventory refers to items in the manufacturing stage and being prepared to become a finished good for sale. Work in process inventory comprises the cost of labour, raw materials, and any production-related overhead expenses. It does not include any raw materials that have yet to be used to manufacture commodities or things already prepared for market sale. As a business manager, overseeing and managing a company’s warehouse, and inventory costs and levels is crucial to maintaining the stock at targeted levels through inventory management.

WIP inventory is mainly concerned with businesses in the manufacturing, construction, consulting, etc. industries. In general, it is suggested that you compute your inventory periodically, such as every two weeks, at month’s end, or every three months. It should be noted that work in process inventory is another name for work in progress inventory, both of which are shortened as WIP inventory. Is there a difference in meaning between these phrases, or are they synonymous? Let’s see.

Comparing Work in Progress and Work in Process Inventory

Despite being used interchangeably, the meaning of these two phrases in the business language is different. The main distinctions between work in progress and work in progress are as follows:

Raw materials quickly transformed into final commodities are referred to as work in process inventory. On the other hand, work-in-progress inventory, frequently used in the construction industry and other service-related industries, describes how a project is progressing overall and how much it costs concerning its progress. Additionally, both names have the same meaning when used by companies that sell actual goods. Work in process refers to unfinished items that will soon be transformed into finished goods.

For instance, a bakery producing 50 packets of bread or a company that makes mobile phones assembling various components for an order will be considered to have work in process. While work in progress takes a long time to convert into a finished product. For example, a building whose five floors are to be constructed out of a planned twelve floors building is a WIP example. Renovation, tasks, and services can all be referred to as work in progress, which is more comprehensive than work in process. Work in process is often exclusively used for things that are currently being manufactured.

Importance of Work in Process Inventory

The what is explained in work in process inventory definition above, but the why is not. Why do businesses keep partially finished inventory? The fact that things are being created is the most evident. They can be fabricated on a conveyor belt, or they might be in line for additional processing. They are actively being produced in any case. Safety stock, buffer stock, or anticipation inventory are additional justifications for work-in-process inventory.

Some businesses find it advantageous to keep products in stock throughout specific production phases as backup against supply shortages or surges in demand. Although classifying WIP material that is stored in a warehouse awaiting assembly may seem tiresome, it is essential for tracking and enhancing your supply chain and inventory control. Keeping too much work in process inventory is often inadequate for a company’s financial line. This is due to a few factors:

- WIP inventory consumes room on a production floor or in a storage facility that could be utilized for merchandise that is ready to sell, raising carrying costs.

- Your capital is more heavily invested in inventory awaiting sale the more WIP you have on hand.

- The danger of items being misplaced, damaged, out-of-date, or lost before they can be assembled increases when there is excessive WIP inventory.

Work in process inventory should also be classified because it significantly impacts your company’s worth. In addition, even though work-in-process inventory is counted as an asset when you seek a loan, the lender might be wary of using it as collateral because it isn’t very liquid.

The Importance of Calculating Accurate Work in Process Accounting

Every business pays close attention to its cash flow statement and overall financial stability. On the other hand, small to medium-sized companies frequently have little to no tolerance for the mistake, but more prominent corporations may tolerate a few more faults owing to scale and average. Three crucial factors make calculating WIP accounting essential. They are listed below:

Taxes

Nobody wants their country’s tax office to audit them for filing incorrect taxes. WIP inventory is a taxed item since it is a current asset, and any understatement or incorrect accounting may incur significant penalties. Overestimating can result in producers paying huge taxes when they are not necessary, which is equally dangerous.

Cash Flow and Financing

Many businesses turn to short-term financings, such as work in the process of inventory financing, to solve short-term cash flow concerns. Accurate WIP accounting and valuation are a must for this kind of financing, and if either is done incorrectly, the short-term financing agreement may be terminated. Accurate values are also employed when evaluating a company’s health for a longer-term loan.

Impact on Production

Production mistakes can also be caused by inaccurate WIP accounting. Upstream operations may be activated to make up a perceived loss or idled to enable a perceived overage to diminish if one segment of WIP is valued too highly or too lowly. If the WIP computation and value were incorrect, the plant may go out of balance, affecting delivery schedules and resulting in financial losses since fewer future sales would be made.

Inaccurate accounting can also send the wrong demand signals when purchasing raw materials, which results in overordering materials and decreased cash flow. This excess inventory or underordering materials and increasing costs due to equipment shutdown will pause to bring in of the necessary material. This can be reduced only once the error is discovered.

Terms and Formulas to Know Before Calculating WIP Inventory

Calculating WIP inventory has several components, the same as other computations. Calculating this becomes impossible without knowing these elements. So let’s learn more about these parts so that you can rapidly calculate your inventory:

Beginning Work in Process Inventory Cost

The beginning work in process inventory cost represents your balance sheet’s asset column for the preceding accounting period. You must identify the ending WIP inventory from the previous accounting period and carry it forward as the beginning inventory for the current fiscal year to compute the cost of your beginning WIP inventory. Your ending WIP inventory may be seen on your balance sheet under existing assets.

Cost of Manufacturing

The costs involved in creating a finished product that can be sold are all included in the manufacturing cost of your goods. It covers the price of labour, raw materials, and any other production-related expenses. The quantity of work in process inventory on hand causes the manufacturing cost to increase. The cost of production rises as inventory in the process increases. As a result, this raises the price of manufactured items. Calculate the cost of manufacturing using the work in process inventory formula given below:

Manufacturing Costs = Raw Materials + Direct Labor Costs + Manufacturing Overhead

Cost of Manufactured Goods

The overall expenses incurred to produce a finished good are referred to as the cost of manufactured goods (COGM). To determine the worth of your current in-process inventory, you must know the final COGM. The COGM is calculated by adding your starting work in process inventory to the production expenses. The ending result in process inventory is then subtracted, giving you the final cost of manufactured products. The equation is:

COGM = Total Manufacturing Costs + Beginning WIP Inventory – Ending WIP Inventory

How to Calculate Work In Process inventory?

The work in process inventory formula combines the beginning work inventory for the subsequent period with the ending work inventory for that period. Once you have calculated your starting in-process inventory, manufacturing expenses, and cost of made items, you can quickly ascertain how much work in process inventory you have. WIP inventory is estimated using the following formula:

Beginning WIP Inventory = Ending WIP Inventory – Manufacturing Costs + COGM

How to Get Beginning Work in Process Inventory?

There is no difference between starting and finishing work in process inventory; the only difference is the accounting period. Work in process inventory is always calculated by businesses after accounting periods, whether those periods be quarters, years, or other durations. Therefore, this total WIP value represents the beginning and the conclusion of the work-in-progress inventory for the relevant accounting period.

The current balance sheet of your business includes this ending WIP inventory as a current asset. Therefore, you need the initial work in process inventory to understand how to discover work in process inventory. You will also need the finishing work in the process inventory to compute it.

How to Calculate Ending Work In Process Inventory?

Before calculating your inventory in-process, manufacturing cost, and COGM, you must first compute your beginning work in process inventory. Once they have been established, you may quickly add your WIP inventory using the method below:

Ending WIP Inventory = Initial WIP Inventory + Manufacturing Cost – COGM

Let’s look at an example to comprehend better how to compute this:

Imagine that your business’s work in process inventory at the start of the new year is $125,000. You spend $100,000 on manufacturing expenses in the same year, and your cost of manufactured goods (COGM) is $1,75,000. Consequently, the ending in process inventory would be:

Ending WIP Inventory = Beginning WIP Inventory + Manufacturing Costs – COGM

$125,000 + $100,000 – $175,000 = $50,000

Your ending WIP inventory would be $50,000.

Suggested Read: What is Ending Inventory?

How to Cut Down Your Work in Process Inventory in 2023

Managing all sorts of inventory and supply chains are now well-established domains of specialization. And these occupations all concur that it’s generally ideal for keeping the inventory of work in progress to a minimum. The greater your work in process inventory:

- The fewer storage options you have for your most lucrative goods

- The more money you have invested in products that won’t sell

- The greater the chance that unfinished items may expire or become outdated

Associating a cost with a completion percentage makes determining WIP inventory complex. Not a simple task to do, so reducing WIP inventory before reporting is a standard procedure. The following practices mentioned below can reduce your work in process inventory:

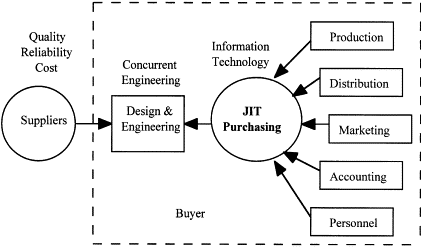

Just in Time Procurement

A production technique known as “just-in-time inventory” involves bringing in the materials as needed based on demand. It is a method many businesses use to cut down on resource and financial waste. The primary goal of this strategy is to eliminate excess inventory, waste of commodities, overproduction of items, and management of storage expenses, among other things.

Better Coordination

This advice may not be as technical, but it is just as crucial as any technological strategy. Coordination is the secret to managing a good, profitable, healthy business. Ensure your staff members share the same objective of creating as much as possible with the given resources if you want to maintain an ideal level of WIP inventory. To function effectively, they must know every step in the production process. In addition to assisting you in maintaining a perfect level of work in process inventory, this will also hasten the manufacturing and supply process.

Upgrading to New Equipment

It’s crucial to provide qualified workers with the appropriate tools and equipment. To increase their output, they require the right equipment. The fastest and most affordable strategy to reduce WIP is to keep equipment in good condition.

How to Improve Work in Process Inventory Flow in 2023?

Most e-commerce businesses rely on a manufacturer or supplier for sellable items. Therefore, it is essential to comprehend the process and movement of in-process inventory since it might indicate how efficiently your supplier or manufacturer creates finished goods. Additionally, you may find ways to strengthen the supply chain by working closely with your supplier and other partners in your retail supply chain, such as a 3PL company. Some of the main methods are listed below:

Source the Right Supplier

You probably won’t have much insight into the work in process inventory process unless you sell a highly customized product. Then, you influence the manufacturer you choose to engage with and the products you source. Still, it is up to your manufacturer to monitor WIP levels and look for methods to save costs while enhancing labour, workforce, and production procedures. First, however, you can ask your provider about things like:

- From whence do the raw materials originate?

- Is it possible to reduce expenses and manufacturing lead times?

- Can your products be manufactured locally?

Use a 3PL to Assist You With Inventory Management

The main asset of an e-commerce company is frequently its inventory. Therefore, you will need a system to track inventory as it is sold after your work in process inventory transforms into sellable items. The technology used ultimately interacts with your store, allowing you to effortlessly manage all inventory and orders from a single dashboard while they handle order fulfilment on your behalf.

Conclusion: How InventoryLogIQ Can Help You to Optimize Your Inventory Management With WIP Inventory

In a period of exceptional supply chain disruptions that cause a lack of raw materials and longer lead times, keeping an eye on supply chain efficiency is crucial. In addition, many retailers predict demand and order goods months in advance due to the longer lead times. Therefore, collaborating closely with suppliers to get the most precise lead time predictions possible to prevent a buildup of WIP inventory is crucial.

Accurate inventory cycle counts made possible by an integrated warehouse management system (WMS) are another crucial aspect of maintaining low work in process inventory levels. In addition, accurate, real-time inventory counts allow for more precise forecasting, facilitating simpler, more effective communication with suppliers and freight forwarders. Small to mid-sized retailers may use enterprise-level inventory management tools to improve their WIP inventory flow by outsourcing their requirements to a company like InventoryLogIQ. InventoryLogIQ is a dedicated inventory management platform that can help your business in the following ways:

Enables a More Accurate Value for Your Business

Work in process inventory is an inventory asset. Thus, failing to account for it on your company’s balance sheet might result in an undervaluation of your overall inventory. The price of your final items will be inflated as a result. InventoryLogIQ’s services help accurately determine the value of your inventory for tax purposes.

Detects Red Flags Faster

For managers, rising WIP inventory levels are a warning sign. A significant WIP inventory level may indicate bottlenecks in your manufacturing process and that the process isn’t running correctly. With InventoryLogIQ, you can identify and fix these issues before they hurt your bottom line by tracking WIP.

Prevents Counting Inventory Manually

InventoryLogIQ helps you to assess the value based on the present stage of each unit in the production process. As some businesses physically count their WIP inventory, this wastes a tonne of time and keeps your staff from working on more complicated tasks. You can estimate the worth of your inventory using the work in process formula without the hassle of manual counting.

Suggested Read: What is the Physical Inventory Counting Method?