What is the FIFO Method of Inventory Valuation? How to Value Inventory Using FIFO Inventory Valuation in 2023?

Inventory valuation is figuring out the worth of the products in stock at a specific moment in the eCommerce sector. The cost of goods sold (COGS) on financial accounts, the amount of taxes due, and decisions regarding how much inventory to hold and when to refill all depend on this value, which is crucial for many reasons. In the eCommerce sector, inventory can be valued using a variety of techniques, such as:

- First-In, First-Out (FIFO): This method evaluates inventory because the first items entered are also the first to be sold or used.

- Last-In, First-Out (LIFO): Here, inventory is valued based on the notion that the last items added to it are the ones that are sold or used first.

- Average Cost: This method calculates the average price by dividing the entire cost of the inventory’s goods by the total number of items on hand.

- Specific Identification: Using the item’s cost as a basis, this method values each item in the inventory.

An eCommerce company’s financial statements may be significantly impacted by the method employed to value inventory. If you use the FIFO method of inventory valuation, your cost of goods sold may be greater, and your profit margin may be lower, but if you use the LIFO approach, your goods sold may be lower, and your profit margin may be higher. Therefore, it is crucial for eCommerce companies to assess which strategy is best for their operations carefully and to maintain consistency over time with their inventory valuation techniques.

- What is FIFO Inventory Evaluation?

- How To Value Inventory Using the FIFO Method of Stock Valuation?

- Using the FIFO Method of Inventory Valuation to Calculate Inventory Cost

- Advantages of Using FIFO Inventory Valuation

- Disadvantages of Using FIFO Inventory Valuation

- Best Practices to Make the Most of the FIFO Method of Stock Valuation in 2023

- Conclusion: How Inventory LogiQ Helps With Inventory Management in 2023

- FIFO Method of Inventory Valuation: FAQs

What is FIFO Inventory Evaluation?

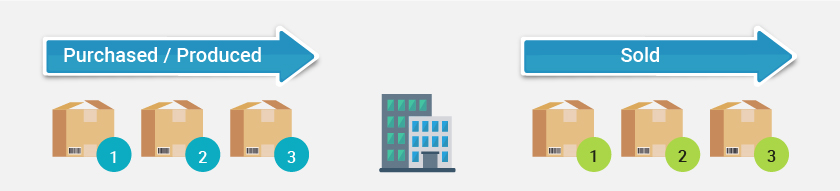

According to the FIFO method of inventory valuation, the first things added to the inventory are also the first ones to be sold or used. This means that while the newest things continue to be in stock, the items that have been in stock the longest are the ones that get sold or used first. This approach is predicated on the idea that items with the longest inventories will probably have a lower value due to depreciation or obsolescence.

The FIFO method of stock valuation is widely utilised in the industrial and retail sectors because it accurately depicts how goods are typically sold or used in these business types. For example, a merchant typically sells the oldest things in-stock first because they have been on the shelf the longest and are more likely to expire or go out of style. Similarly, a manufacturer would generally start using the oldest raw materials and components first because they have been in the warehouse the longest and are most likely to go wrong or need to be updated.

The FIFO method of inventory valuation is one of several approaches that may be used to assess inventory, and it’s crucial to select the one that’s most suitable for a particular firm. The LIFO (last-in, first-out) method, the average cost method, and the specific identification method are more approaches.

How To Value Inventory Using the FIFO Method of Stock Valuation?

You must determine COGS after the accounting period or fiscal year because eCommerce inventory is regarded as an asset. Therefore, your balance sheets and inventory write-offs are impacted by ending inventory value. More current merchandise often costs more than older stuff due to inflation. Since the lower-valued items are sold first using the FIFO method of inventory valuation, the ending inventory usually has a higher value. Furthermore, any excess inventory after the fiscal year does not impact the cost of goods sold (COGS).

It is critical to remember that FIFO method of stock valuation was created for inventory accounting requirements and offers a straightforward formula to determine the value of ending inventory. However, it’s only sometimes the case that what’s received first is sold and fulfilled first. However, the FIFO method of inventory valuation offers a double benefit of excellent inventory management and a simple method for determining ending inventory value if you sell goods with a limited shelf life, are perishable, or tend to become obsolete rapidly.

You can track and control quality, reduce the risk of high inventory holding costs for retaining out-of-date or no longer marketable inventory, and calculate inventory value that corresponds to the natural movement of inventory throughout your supply chain (also known as dead stock). The drawback of employing the FIFO method of inventory valuation is that it might result in considerable disparities when COGS climbs dramatically, even though it is the simplest and most popular valuation method. Profits will suffer if product costs triple, but accountants use figures from months or years earlier. Additionally, it only provides tax benefits if prices are declining.

Using the FIFO Method of Inventory Valuation to Calculate Inventory Cost

The FIFO method of inventory valuation is used to compute inventory costs as follows:

Assume a product is produced over a year in three batches. Each batch’s costs and size are as follows:

- Batch 1: 2,000 pieces, $8000 in production costs

- Batch 2: 1,500 pieces, $7000 in production costs

- Batch 3: 1,700 pieces, $7700 in production costs

5,200 pieces were made with a total cost of $22,700. $4.37 is the average price per piece to make. The unit costs for each batch that is produced must then be determined.

- Batch 1: $8000/2000 = $4

- Batch 2: $7000/1500 = $4.67

- Batch 3: $7700/1700 = $4.53

Let’s assume that, of the 5,200 units produced, 4,000 were sold over the year. First, you need to determine which items were sold for what price. Under FIFO inventory valuation and accounting, you begin by assuming that you have sold the oldest (first-in) produced items first to calculate the cost of units sold. Accordingly, using FIFO, of the 4,000 units sold:

- You presume the first 2,000 goods from Batch 1, each costing $4, were all sold. The cost per unit for the first 2,000 units from Batch 1 sold was $4.00. Eight thousand dollars total.

- $7,005 was spent on 1,500 units from Batch 2 for $4.67 each.

- For a total of $2,265 and $4.53 per unit, the final 500 pieces from Batch 3 were sold.

- The cost of the 4,000 goods sold comes to $17,270 when these expenses are added together.

This computation must accurately reflect what occurred because it is challenging to know which products from which batch were sold first in this kind of scenario. Therefore, it’s only a means of obtaining a calculation.

Advantages of Using FIFO Inventory Valuation

We have already covered the definition of FIFO, its significance, and some examples in this post. The numerous benefits of utilising the FIFO method of inventory valuation are introduced to us in this section:

Unquestionably Popular

FIFO method of stock valuation is widely used and accepted around the world. Its adherence to the IFRS makes it a globally favoured application approach. In contrast to LIFO, primarily utilised in the US, FIFO is accepted worldwide.

Logical and Simple

Almost all firms may quickly adopt the FIFO inventory valuation method, which is also simple to understand. This strategy functions well for most firms with a cycle from selling oldest to newest. Additionally, it is user-friendly due to the straightforward cash flow analysis.

Prevents Manipulation

A significant benefit of FIFO is that it makes it challenging to manipulate the reported income in financial accounts. This can save your business from the stress of dealing with instances of theft and mismatched inventory records.

Saves Time and Money

FIFO method of stock valuation can help reduce the time and costs associated with estimating the cost of the inventory being sold. This is so that the price can directly reflect the cash flows from previous purchases that would be utilised first.

Increases Gross Profit

The FIFO approach produces a cheaper cost of goods sold (COGS). As it shows future development and profitability, this can excite potential investors, which will lead to more capital and also results in increased profit margins per item.

Aligns Costs With Inflation

By keeping the newest inventory on hand for future sales, businesses can use the ability to align expenses with inflation. The newer stock can then be sold for more money, keeping up with inflationary times and giving the businesses a competitive advantage.

Avoids the Danger of Obsolescence

By employing the FIFO method of stock valuation, firms may eliminate the possibility of suffering losses from sales of out-of-date or expired goods. Companies can determine and establish a predictable flow of commodities by clearing the oldest stock first.

Disadvantages of Using FIFO Inventory Valuation

Because the FIFO method of inventory valuation is simple to comprehend and apply, many firms like it. There are certain drawbacks, though. The immense disparity between costs and revenue under the FIFO technique may mean higher income taxes for the business. The company’s profits may be overstated as a result of this. Here are some of the drawbacks of using FIFO:

Increased Tax Burden

The First In, First Out approach will provide more significant profits, leading to higher “Tax Liabilities” in that specific period. This is one of the most significant drawbacks of the FIFO accounting method. This can lead to more extensive tax obligations and financial outflows for taxes.

Reduced Functionality During Unforeseen Circumstances

In times of “hyperinflation,” using the First In, First Out approach is not an acceptable inventory measurement method. When this happens, there is no consistent pattern of inflation, which could cause sharp increases in the cost of commodities. Therefore, it would not be suitable during these times to match the majority of previous purchases with the most recent sales and would provide a skewed picture because the profit might be inflated.

Not Suitable During Price and Demand Fluctuations

If the goods/materials acquired fluctuate in price patterns, the FIFO method of inventory valuation would not be a suitable measurement. This can lead to inaccurate profits for the same time frame.

Large Amounts of Data is Needed

Although the FIFO method of inventory valuation is simple to understand, extracting and operating the costs of products can be laborious and awkward due to a large amount of needed data and the potential for clerical errors.

Best Practices to Make the Most of the FIFO Method of Stock Valuation in 2023

It’s crucial to consider both the accounting and inventory management sides when implementing a robust FIFO inventory valuation system in your warehouse or store. Both have best practices that you should adhere to manage your inventory effectively, acquire an accurate cost analysis of your company, and provide the best possible customer service. Businesses can successfully use the FIFO method of stock valuation and guarantee that their inventory is priced accurately and consistently by adhering to these best practices. Observe the following excellent practices:

Create Explicit Policies and Processes

To guarantee that the FIFO method of inventory valuation is implemented consistently, it is crucial to have policies and procedures in place that are both clear and well-defined. Establishing protocols for receiving, storing, and selling merchandise may be part of this.

Use a Computerised Inventory Management System

Keep track of the age of items in your inventory and ensure the FIFO approach is constantly followed. By utilizing advanced inventory management software, you can have access to all the information you need from a single dashboard, which makes inventory management using the FIFO inventory valuation more efficient and streamlined.

Keep Accurate Records

In order to properly apply the FIFO method for stock valuation, it is important to keep accurate records of the dates when items are received and sold. This can be done through a good inventory management system or through manual record keeping. Some ways to do this could involve recording the date things are added to inventory, their price, and applicable expiration dates.

Track Inventory Levels

Monitoring inventory levels is essential to ensuring that the FIFO approach is constantly used. When necessary, goods should be reordered. Regular physical inventory checks can help ensure that the records of what is in inventory are accurate and up to date. This is especially important if the business has a high turnover of inventory.

Train Your Employees

Employee training is crucial to guarantee that workers know the FIFO approach and how to apply it to their everyday activities properly. This will help them understand the procedures they need to follow to ensure that the relevant products are moved out quickly.

Consider the Type of Goods Being Sold

Some types of goods, such as perishable items or seasonal products, may have a shorter shelf life and should be sold more quickly. It may be necessary to adjust the FIFO method for these types of goods in order to ensure that they are sold before they expire or become obsolete.

Use Batch Tracking

If a business manufactures products or receives goods in large batches, it can be helpful to track the specific batch or lot number of each item. This can make it easier to identify the oldest items that should be sold first under the FIFO method.

Conclusion: How Inventory LogiQ Helps With Inventory Management in 2023

The inventory cost in your accounting system can be calculated using the popular FIFO method of inventory valuation. It can also relate to how inventory moves through your warehouse or store, both used in tandem with one another to manage your inventory. The most straightforward inventory management strategy is FIFO. Several accounting software systems employ it as their sole technique. It is advised that you manage your inventory using one of these accounting software choices to ensure that you accurately record the cost of your merchandise when it is sold. This way, you’ll better understand how much money you’re generating with each item you sell as a result of doing this.

The tech-enabled retail fulfilment solution Inventory LogIQ is intended for direct-to-consumer and B2B eCommerce businesses that are rapidly expanding. Inventory LogIQ employs a tracking system with a lot of features that let you divide SKUs based on their lot numbers for inventory tracking and precise fulfillment. If you have a lot of items, you can be assured that your inventory will be stored safely and securely to avoid confusion.

Inventory LogIQ can recognise which items are at risk of expiring first and always ships those items first using the FIFO inventory valuation method. We will always ship the bin that has been updated with a lot date if you have products kept in two different bins, one with no lot date and the other with one. The integrated inventory management solutions in our premium fulfillment software also assist you in:

- Real-time inventory monitoring

- Managing every SKU

- Analyzing sales patterns to predict demand