What is Inventory Valuation? Importance, Objectives, Methods, and Challenges in 2023

When you become an eCommerce seller, inventory becomes your biggest asset and a majority of your capital investment goes into procuring it and storing it until it gets sold and starts to recover your expenditure. The value of the assets of any business provides insight into the financial condition of that business. A business is believed to be in good condition if its balance sheet shows that it has more assets than liabilities. It can be calculated if the business has kept records of every asset, sale, order, profit margin, liability, etc.

In terms of business, these records are referred to as inventory valuation. The most important aspect of calculating inventory is knowing how much your inventory is worth during a financial time period like a quarter or fiscal year. It impacts the cost of goods sold (COGS) which ultimately determines the overall financial health of your business.

In this guide, we will review the critical aspects of inventory valuation, the different methods used, and how to control inventory.

- What is Inventory Valuation?

- Why is Inventory Valuation Important for Businesses?

- What Are the Objectives of Inventory Valuation?

- 4 Most Prominent Inventory Valuation Methods in 2023

- What are the Challenges of Inventory Valuation?

- How to Choose the Right Inventory Valuation Method in 2023 and How Can Inventory LogIQ Help?

- Conclusion

- Inventory Valuation FAQs (Frequently Asked Questions)

What is Inventory Valuation?

Inventory valuation is a term used for calculating the value of inventory a company has during a particular time period. Inventory is a prime asset of an organization and to record it in the balance sheet, it needs to have a monetary value. This value can help you measure your inventory turnover, which will help you to plan your purchasing decisions. It is based on the total costs incurred to acquire the inventory and get it ready for sale.

You can find out yours by evaluating your cost of goods sold (COGS) and ultimately, your profitability. The most widely used inventory valuation methods are WAC (Weighted Average Cost), FIFO (First-in, First-out) inventory valuation, and LIFO (Last-in, First-out) inventory valuation.

[contactus_uth]

Why is Inventory Valuation Important for Businesses?

The cost of goods sold (COGS), gross income, and the monetary worth of inventory remaining at the end of each accounting period are all affected by how a company conducts inventory valuation. As a result, inventory valuation has an impact on a company’s profitability and prospective value as shown in its financial accounts. A few points that stress the importance of inventory valuation are listed below:

Impact on the Cost of Goods Sold

If the volume of goods sold is high at the end of the period of calculating inventory valuation, the total cost of goods sold will also be higher which means that most products from the inventory have been sold. Alternatively, if inventory has a lower valuation, holding costs will increase which will also lead to a higher overall cost. As a result, it has a significant impact on the profit levels reported.

Impact on Multiple Records

If the inventory valuation is not calculated correctly and on time, the errors may be recorded repeatedly for the next quarter/fiscal year. Because of the incorrect ending balance in the first period, it will be carried forward into the beginning inventory balance of the next reporting period, causing multiple errors in reported profits in two consecutive quarters or years, because of which, the balance sheet will not tally as more assets will always be shown.

Impact on Loan Ratios

If a business owner wants to take a loan for their business, the lender will base the loan on the company valuation and after passing it successfully, a restriction on the permitted proportions of current assets to current liabilities may be included in the loan agreement if a business has received a loan from a bank or lender. The lender has the option to cancel the loan if the entity fails to satisfy the target ratio. Inventory valuation is important because inventory is often the major component of the current ratio.

Impact on Income Taxes

When the balance sheet is involved during company valuation, the amount of income tax paid can be affected by the inventory valuation method used. The LIFO (Last-in, First-out) approach is widely used to lower income taxes paid during periods of rising prices.

LIFO matches current sales and current costs of those sales with historical sales. If the production costs of an item increase due to inflation, the cost of goods sold is increased under LIFO, which creates a higher cost of goods sold tax deduction and thus, a lower taxable income.

What Are the Objectives of Inventory Valuation?

The term inventory refers to products that are for sale. It covers raw materials, semi-finished items, and finished goods. At the end of each fiscal year, inventory valuation is performed to determine the cost of goods sold and the cost of unsold inventory.

This is critical because any excesses or shortfalls in inventory have an impact on a company’s production and profitability. There are various reasons to evaluate inventory. A few of them are:

To Evaluate the Capital Invested in the Business

You must have spent a lot of capital on your business, like most other retailers. Some of that money must have been spent on fixed assets like stores, warehouses, furniture, computers, etc., and most of it on assets that are variable in nature. Getting the value of fixed assets is a relatively simple task but knowing the monetary value of inventory is much more difficult so this is where inventory valuation can help.

To Get the Sales Velocity of the Company

If you operate a small eCommerce business, it is much easier to conduct inventory valuation but when you provide the data of a specific time period in your balance sheet, it shows how many items you sold in that certain time period. This can give you an idea of how smartly you rotate your money on buying and selling your inventory.

To Determine the MOQ and EOQ

When you evaluate inventory at the end of an accounting period, you are able to figure out how many products you have sold during that period so you know how much inventory you need to keep in stock to avoid overstocking and understocking. You can calculate the economic order quantity (EOQ) to get the ideal order size and the minimum order quantity (MOQ) so that you have an idea of the least amount of money you will need to spend on procuring inventory.

To Get Help in Taking Valuation-Based Loans

When a business owner wants to expand their business by adding more products to their selling list, listing the available products on multiple selling channels, and arranging for storage in multiple warehouse locations, it requires a steady amount of investment.

Most of the time, sellers take loans to invest in infrastructure for expansion. So for that purpose, banks demand access to the balance sheet to check the inventory valuation of the company to determine if they are eligible for the loan or not.

To Determine the Gross Income

As your inventory is stored with the ultimate goal to sell it and generate revenue, inventory valuation can easily show you the money that has been invested, earned, and is held up in procuring it.

To determine the gross profit, match the cost of goods sold with the revenue of the accounting period.

Cost of goods sold = Stock at beginning of the accounting period + Purchases – Stock at the end of an accounting period.

The equation shows how inventory valuation influences cost and ultimately, the gross profit.

To Reflect the Financial Position of the Business

Inventory after closing is considered a current asset. The financial status of the business is determined by the value of the shares while filling out the final balance Sheet. Overvaluation or undervaluation can show a false image of a company’s working capital and overall financial position.

To Show Any Gaps Between Assets and Liabilities

An asset valuation tells you about the total value of assets you have at the end of a particular time period. When you have a strong idea about the figure of the valuable assets in your business, you can compare it with the liabilities and implement processes to reduce them such as extra warehouses, removing non-performing assets, getting rid of useless supply chain partners, etc.

4 Most Prominent Inventory Valuation Methods in 2023

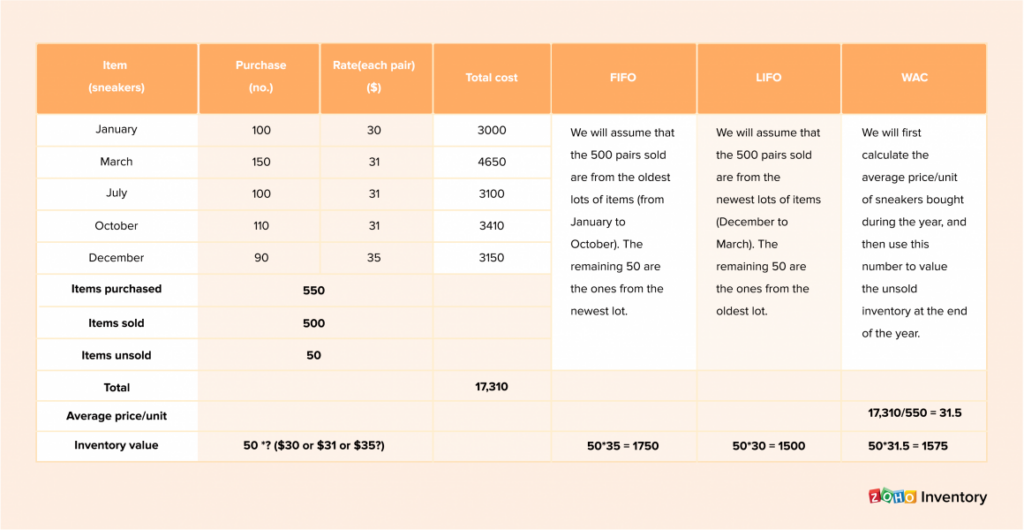

First-In, First-Out (FIFO)

This strategy works with the idea that the first inventory purchased should be sold first. The remaining inventory assets are then matched and marked as the most recently purchased or produced assets. Because it is simple and easy to implement, it is one of the most commonly used inventory valuation methods by eCommerce sellers. The FIFO approach gives you a higher value of remaining inventory, a lower cost of goods sold, and a higher gross profit if there is inflation.

During inflation, when prices rise quickly, the FIFO model fails to provide a realistic picture of the costs. It also does not provide any tax benefits, unlike the LIFO technique.

Last-In, First-Out (LIFO)

As the name suggests, this inventory valuation method works on the idea that newer goods are sold first while the older inventory remains in stock. Businesses rarely adopt this strategy since older inventory can increase holding costs and become obsolete over time. The business suffers a big loss as a result of this.

The LIFO method is used at a time when eCommerce businesses expect inventory costs to rise over time because of price inflation. Businesses’ declared profit levels can be reduced by transferring high-cost inventory to the cost of goods sold which enables companies to pay less tax as a result of this.

Specific Identification Method

Every item in your inventory is recorded using this inventory valuation method from the time it is stocked until the time it is sold. It is typically reserved for large items that are immediately identifiable and have a wide range of features and costs associated with them.

The ability to trace each item individually using an RFID tag, stamped receipt date or serial number is the most important prerequisite for this system. While this method provides a high level of accuracy in inventory valuation, it is limited to valuing uncommon, high-value items that require these extra procedures. You can read more about inventory accuracy here.

Weighted Average Cost Method

Under the weighted average cost method, the weighted average is used to determine the amount that goes into the cost of goods sold and inventory. The weighted average cost per unit is calculated as follows:

Average Cost Per Unit = Total Cost of Inventory Goods / Sum of Total Units in Inventory

The above inventory valuation method is mainly used to determine the cost for the total sum of units that are indistinguishable from one another and when it is difficult to track the cost of individual items.

It can be used to calculate inventory valuation by very niche businesses though it does not provide the actual valuation of a business.

What are the Challenges of Inventory Valuation?

Determining the Total Cost of Inventory

Use COGS for calculating the cost of your inventory:

COGS = Inventory at starting + Purchases – Inventory left

Therefore:

Inventory left = Inventory at starting + Purchases – COGS

The value of Inventory at the start and end of an accounting period may not be as simple as it appears. Anything you can’t sell for MRP due to damage, obsolescence, or even shifting consumer tastes must be marked down and valued properly. This makes determining the total cost of inventory a challenging affair.

Determining the Amount of Inventory Left

This is more challenging than it appears. If a business has products in transit, it must decide whether or not to include them in the inventory valuation. Many businesses keep track of goods using a periodic inventory management system. Companies use this technique to evaluate inventory after each accounting period. A perpetual inventory system, on the other hand, tracks every purchase order and sale, and updates inventory to reflect those transactions regularly.

Adding Other Related Costs

When you evaluate your inventory, you do not only add up the costs of the products you have but also the costs of procuring it like the transportation cost, inventory holding cost, delivery cost, insurance cost, packing and picking cost, etc. Even electricity that is utilized to store your inventory can be added to your inventory valuation. Adding the exact value of these expenses with the ratio of remaining inventory can be a challenge for a seller. It is nearly impossible to determine the actual expenses that occur due to the leftover inventory and the further expenses to keep it safe and fresh for as long as possible.

Calculating Depreciation

Depreciation is also a big factor that affects your inventory valuation. With time, inflation not only surges but object values also depreciate. Most of the time, electronic items depreciate when the latest and updated versions come into the market. For example, if you are selling a mobile phone and after a period of a few months, the same company launches a model with more features at the same price, the product sales of the older phone will reduce or stop entirely so ultimately, the company will have to sell it at a lower price.

Valuating Damaged Products

Products after they occur damage are difficult to monetarily evaluate. A seller cannot command its actual price. They can try to sell it as a refurbished product during sales or sell it to a second-hand dealer like Cashify.

The same thing happens with perishable products after a specific duration because storing perishable products is more expensive than the incomes they fetch in a highly competitive market space. Some perishable products demand special warehousing facilities like temperature control, special containers, etc.

Identifying Stock Discrepancy

The stock discrepancy is the difference between the physically available stock or inventory and the current inventory that is recorded in the system. To run a successful business, maintaining accurate stock is important but inventory discrepancy is a common scenario in real-life eCommerce operations.

When it comes to inventory valuation, the stock discrepancy is a big hurdle. To find out the inventory valuation, you should have an accurate figure for your inventory. If there is a disparity in the count, sellers need to find the mismatched amount of inventory by calling the manufacturer, rechecking old bills, etc. and after that lengthy process is done, the seller may not be able to account for those missing items so it can go to waste and cause differences in the final valuation.

Valuing Seasonal Items

The value and pricing of seasonal items change over time. When a season ends, the manufacturers also start offering heavy discounts and when sellers take advantage and procure items, the price of the same product will vary compared to the price it was bought at the beginning of the season.

For example, if you are a garments seller and you sell coats during winter but the weather doesn’t get as cold as you expected which results in lower demand for coats, you will have to store all that inventory till the next winter which can damage the products or make them obsolete as newer designs are introduced in the market.

If you always keep a record of your inventory with the help of inventory planning through inventory management software, you may not find any challenges during inventory valuation.

How to Choose the Right Inventory Valuation Method in 2023 and How Can Inventory LogIQ Help?

When choosing the right inventory valuation method, there is no absolute formula. It depends on the purpose of doing it and the type of inventory.

A few things to note about choosing the right inventory valuation method are:

- FIFO generates the highest gross income at the present time while LIFO generates the least and WAC is somewhere in the middle. Assuming a normal inflationary scenario in which supply costs rise over time, FIFO generates the greatest taxes, while LIFO generates the lowest with WAC again in the center. It minimizes the consequences of inflation and deflation by matching recent income with recent costs.

- When you or your customers want to know the cost and selling price of each unit, Specific Identification is the logical solution. People who buy and sell art may be curious about how the price of a certain piece altered from the year it was last purchased to the year it was sold.

- LIFO, FIFO, WAC and Specific Identification are the most common inventory valuation methods. Some of the others which are used according to the preference of many sellers are:

- First-In, Last-Out (FILO): Seller sells the firstly stored items at last.

- First-Expired, First-Out (FEFO): Seller sells the earliest-expiring inventory first.

- Highest-In, First-Out (HIFO): Seller sells the highest-cost inventory first.

- Lowest-In, First-Out (LOFO): Seller sells the lowest-cost inventory first.

Conclusion

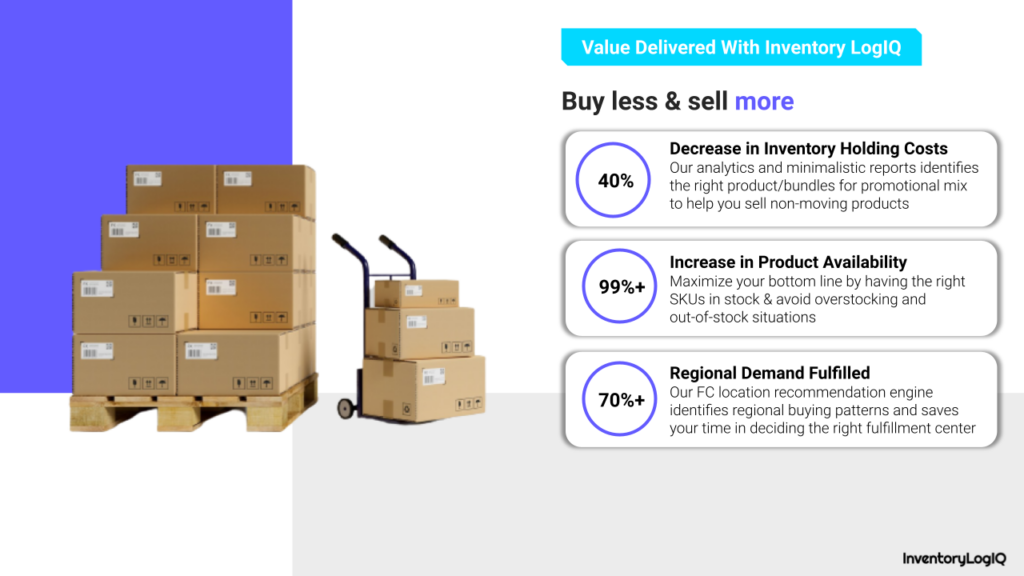

After getting this detailed information on inventory valuation, you must have gotten an idea of how it is helpful in the growth of your business. It is important for you to partner with a company that provides inventory management services by using the best procedures and the most advanced technology.

We at Inventory LogIQ provide our partners with the count, location (warehouse or transit) as well as monetary value of their inventory. We help you know the actual value of your inventory through different inventory valuation methods, handled by experts.

InventoryLogIQ is an AI-driven inventory optimization platform, that allows multi-channel brands to stop losing revenue on out-of-stocks, release cash from overstocked items, and accelerate shipping speed. Inventory LogIQ provides the actual figure of your inventory valuation as well as the value of each and every item that is available in stock through our custom SaaS solution – IMS (Inventory Management Software). To achieve better results in inventory valuation at the end of the financial period, Inventory LogIQ can help in:

- Inventory planning

- Smart inventory placement across multiple warehouses

- LIFO and FIFO methods

- Experts to handle every procedure

- Deciding MOQs and EOQs

- Alerts for replenishment when moving towards out-of-stock situations

Suggested Read: What is Inventory Aging?